( overview )

Startup investment as a family office, not VC or CVC

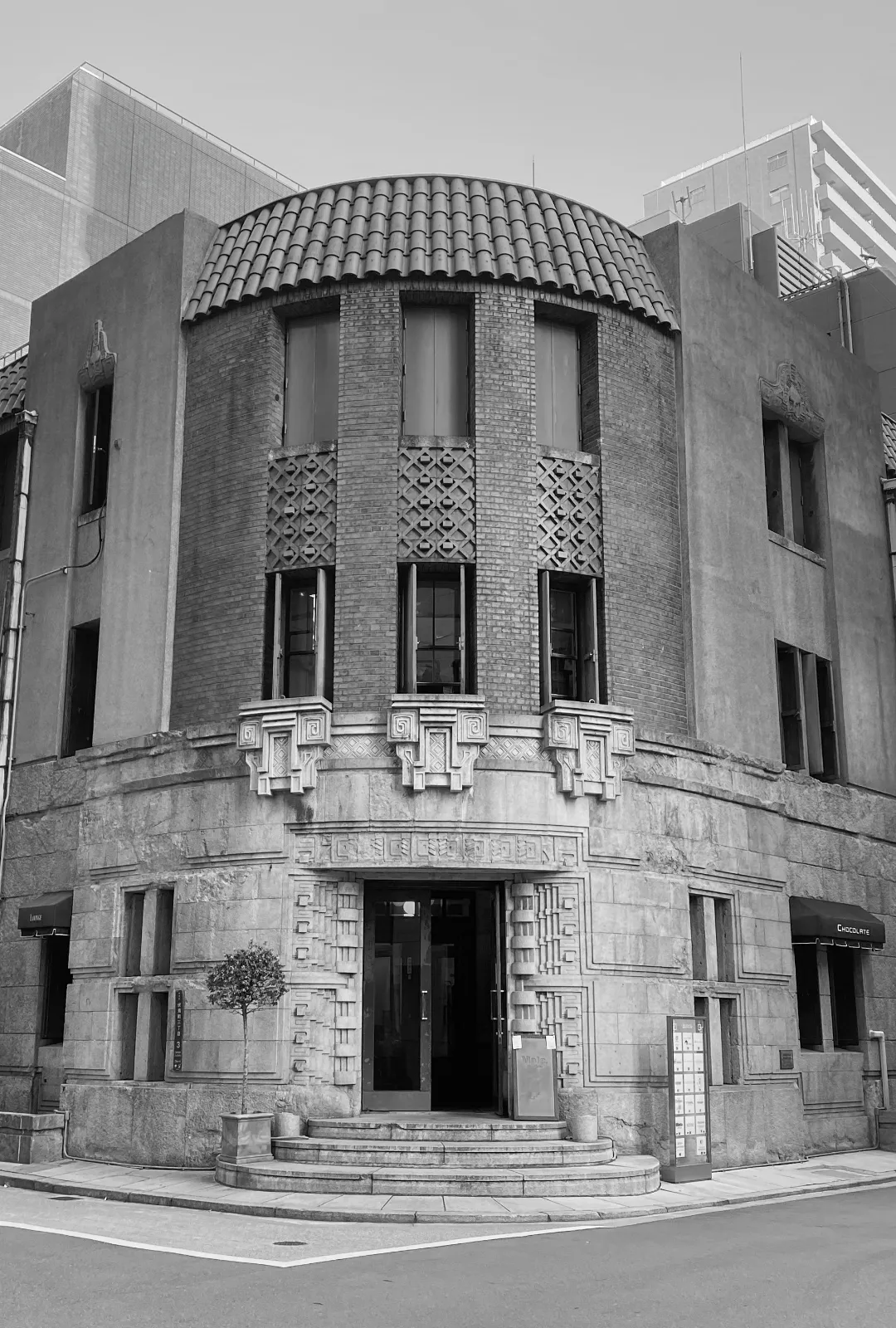

The Shibakawa family, which founded Chishima Real Estate, has been involved in foundation and been supporting various ventures companies since before World War II. A representative example is the support for Dai Nippon Kaju by Shibakawa Matashiro at its foundation as an investor.

This is significantly outstanding part of Shibakawa Family’s history of investment in “New Value”.

We leverage the strengths of our family office to support entrepreneurs who bring innovation to the society.

( Portfolio )

Portfolio

( Lineup )

Three Features of our Startup Investment Business

-

01

Investment focused on post-IPO growth

We view the IPO as a milestone for long-term growth. Our target as investor is to support you to countinuously bring innovation to the society for decades.

-

02

Supporting entrepreneurs on their journey

The key players in business are the entrepreneurs who understand the market and dare to take on challenges. We aim to be a supportive presence, standing by these entrepreneurs as they strive toward ambitious goals and push forward to shape the future, at times giving them the push they need.

-

03

Leveraging our assets to provide support

Chishima Real Estate operates number of businesses globally / locally. We leverage the assets and the network of the businessess to support your innovation for better society.

( Criteria )

Criteria

Our mission is to invest in the business with significant impact on society and with huge potential of long-term growth.

-

01

Midlle/Later stage startups are our priority.

-

02

If you are the leader in domestic market, we are ready to support you to be the leader in the global market.

-

03

You provide long-term growth, and we provide long-term support, even after IPO.